When it comes to investing in mutual funds, two strategies stand out for their simplicity and effectiveness: Systematic Investment Plans (SIP) and Systematic Withdrawal Plans (SWP). Whether you’re a young professional just starting your financial journey or a seasoned investor looking to optimize returns, understanding SIP and SWP can transform the way you manage your money. Let’s dive into what these strategies are, their benefits, and how they work.

What is a Systematic Investment Plan (SIP)?

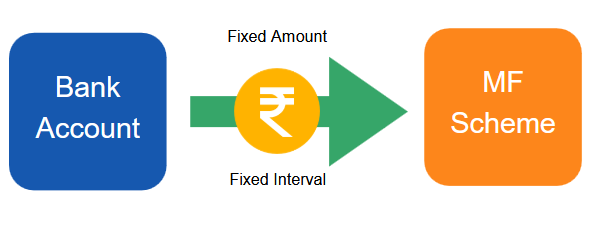

A Systematic Investment Plan (SIP) is a disciplined approach to investing in mutual funds. It allows you to invest a fixed amount at regular intervals—be it monthly, quarterly, or even weekly. SIPs are particularly popular among young investors, thanks to their affordability and the power of compounding.

How SIPs Work

- Consistency: You invest a fixed amount regularly.

- Rupee Cost Averaging: When markets are down, you buy more units; when markets are up, you buy fewer units. Over time, this reduces the impact of market volatility.

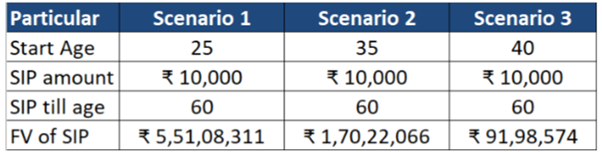

Compounding: Small, consistent investments grow exponentially over time, especially when started early.

Benefits of SIP

- Affordability: Start with as little as ₵500 per month.

- Discipline: Encourages a habit of regular investing.

- No Need to Time the Market: Smoothens market fluctuations.

- Goal-Oriented: Aligns with long-term financial objectives, such as buying a home, funding education, or retirement planning.

Who Should Choose SIP?

SIPs are ideal for:

- Young professionals looking to start their investment journey.

- Investors aiming for long-term wealth creation.

- Individuals with limited upfront capital but steady incomes.

3 Golden Rules for All Investors

For Example:

What is a Systematic Withdrawal Plan (SWP)?

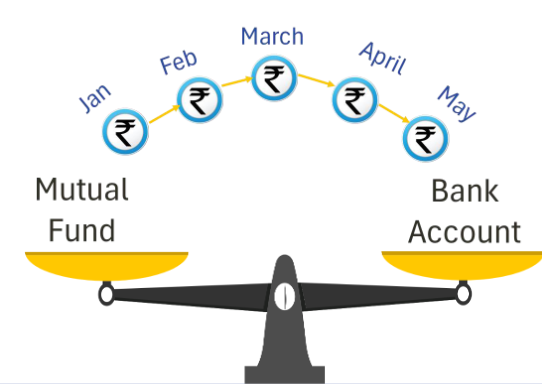

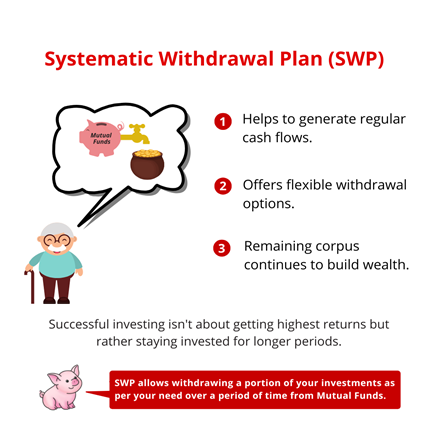

A Systematic Withdrawal Plan (SWP) is the reverse of SIP. It allows investors to withdraw a fixed amount from their mutual fund investments at regular intervals. SWPs are a great way to ensure a steady income while your capital continues to grow.

How SWPs Work

- Customizable Withdrawals: Choose the frequency (monthly, quarterly, etc.) and amount.

- Partial Redemption: Only the required amount is withdrawn; the remaining investment continues to earn returns.

- Tax Efficiency: Gains are taxed only on the withdrawn amount, and if planned well, you can minimize tax liabilities.

Benefits of SWP

- Regular Income: Perfect for retirees seeking a steady cash flow.

- Flexibility: Control the withdrawal amount and schedule.

- Preservation of Capital: Unlike lump sum withdrawals, the core investment remains intact.

- Tax Benefits: Better tax treatment compared to fixed deposits or other traditional instruments.

Who Should Choose SWP?

SWPs are suitable for:

- Retirees needing a consistent income.

- Investors who want to fund specific needs, such as children’s education or household expenses.

- Individuals looking to transition from growth to income-focused investments.

SIP vs SWP: Which One is Right for You?

The choice between SIP and SWP depends on your financial goals:

| Criteria | SIP | SWP |

| Purpose | Wealth creation and long-term growth | Regular income and capital preservation |

| Best For | Young investors, salaried individuals | Retirees, income-focused investors |

| Cash Flow | Outflow (investment) | Inflow (withdrawal) |

| Market Volatility | Helps average costs | Smoothens income during market ups/downs |

How to Start SIP and SWP with Ease

Getting started with SIPs and SWPs is simple:

Steps to Start a SIP

- Choose a Mutual Fund: Pick a fund that aligns with your financial goals and risk appetite.

- Decide Investment Amount: Start small and gradually increase through SIP top-ups.

- Set Up Auto-Debit: Link your bank account for hassle-free investing.

Steps to Start an SWP

- Assess Your Needs: Calculate how much income you need and for how long.

- Pick the Right Fund: Opt for debt or hybrid funds for stable returns.

- Schedule Withdrawals: Set up a withdrawal plan based on your cash flow requirements.

FAQs About SIP and SWP

1. Can I stop SIP or SWP anytime?

Yes, both SIPs and SWPs offer flexibility. You can pause or stop them as per your needs.

2. Is SIP better than a lump sum investment?

For beginners or in volatile markets, SIPs are better as they spread risk over time. However, if you have a large sum during a market dip, a lump sum can be advantageous.

3. Are SWPs tax-free?

No, SWPs are subject to capital gains tax. However, long-term gains are taxed at a lower rate, making them more tax-efficient than some alternatives.

4. Can I use both SIP and SWP?

Absolutely! SIPs help build wealth, and SWPs provide income from that wealth. Many investors use both to balance growth and cash flow.

Final Thoughts

SIPs and SWPs are two sides of the same coin. While SIPs help you accumulate wealth systematically, SWPs enable you to enjoy the fruits of your investments. By incorporating both strategies, you can create a robust financial plan that grows your money and supports your lifestyle.

Ready to start your investment journey or optimize your portfolio? Contact us at Livewell Finserv for personalized advice and solutions. Let’s help you achieve financial freedom, one step at a time!