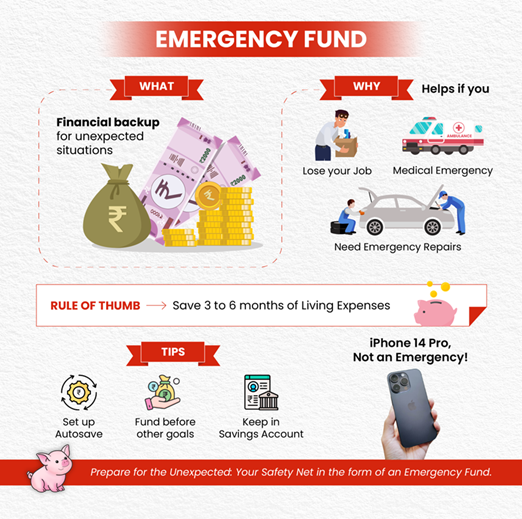

Life is full of surprises—some good, some not so much. Imagine losing your job suddenly, facing a medical emergency, or dealing with an unexpected car repair. What if you don’t have enough money saved to handle these situations? This is where an Emergency Fund becomes your financial safety net.

1. What is an Emergency Fund?

An emergency fund is a cash reserve set aside for unexpected expenses. It helps you cover urgent financial needs without borrowing money or liquidating your investments at the wrong time.

2. Why is an Emergency Fund Important?

- Protects You from Debt

Many people rely on credit cards or loans when faced with sudden expenses. But high-interest debt can become a burden. Having an emergency fund ensures that you don’t have to borrow at all.

- Peace of Mind

Knowing you have money saved for emergencies reduces stress. You won’t have to panic about how to pay bills if a crisis happens.

- Helps You Stay Invested

If all your money is tied up in mutual funds, stocks, or real estate, you might have to sell at a loss during a crisis. With an emergency fund, you can let your investments grow without worrying about sudden expenses.

- Covers Job Loss or Income Gaps

If you lose your job or your business slows down, an emergency fund will help you manage expenses while you find a new source of income.

3. How Much Should You Save?

A good rule of thumb is to save at least 3 to 6 months’ worth of living expenses.

For Example:

If your monthly expenses are ₹30,000, aim for ₹90,000 to ₹1,80,000 in your emergency fund.

4. Where to Keep Your Emergency Fund?

Your emergency fund should be easily accessible but not too tempting to spend. The best options are:

• Liquid Mutual Funds (Best for Emergency Reserves)

- Offers higher returns (~6-7% p.a.) than savings accounts

- Money can be withdrawn within 24 hours

- Suitable for 3-6 months’ worth of expenses

• Savings Account (For Immediate Needs)

- Quick access to cash

- Low-risk but low interest (~3-4% p.a.)

- Best for keeping 1 month’s expenses for instant withdrawals

• Fixed Deposits with Sweep-In Facility – Combines liquidity with returns

- Works like a savings account but offers higher interest (~6-7% p.a.)

- Automatic transfer to savings account when needed

5. How to Build an Emergency Fund?

i. Start Small

Even ₹500 a week adds up over time.

ii. Automate Savings

Set up auto-transfers to a dedicated account.

iii. Cut Unnecessary Expenses

Reduce spending and redirect savings.

Final Thoughts

An emergency fund is your financial shield against life’s uncertainties. Start today and secure your future!

FAQs About Emergency Fund:

1. Can I rely on credit cards instead of an emergency fund?

- No. Relying on credit cards for emergencies can lead to high-interest debt. Having an emergency fund prevents you from borrowing money when unexpected costs arise.

2. Is it necessary to save 6 months’ worth of expenses?

- Yes. While saving 3 to 6 months’ worth of expenses is ideal, even saving a smaller amount provides a cushion for emergencies.

3. Should I use my emergency fund for non-essential purchases?

- No. The emergency fund should only be used for genuine emergencies, such as medical expenses, job loss, or urgent repairs.

4. Is it okay to invest my emergency fund in the stock market?

- No. The stock market is volatile, and it’s important to have your emergency fund in liquid, low-risk options to access funds quickly.

5. Can I build an emergency fund with a small income?Yes. Even saving small amounts regularly can accumulate over time. Start with what you can and gradually increase your contributions.