In the world of investments, Portfolio Management Services (PMS) have gained immense popularity, especially among high-net-worth individuals (HNIs) looking for personalized wealth management. But what exactly is PMS, and how does it work? If you’re looking for expert investment strategies beyond mutual funds, this blog will guide you through everything you need to know about PMS in a simple and easy-to-understand manner.

What is Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) is a professionally managed investment service where an experienced fund manager handles your investments in stocks, bonds, and other financial instruments. Unlike mutual funds, PMS offers a more customized approach to investment management, focusing on personalized strategies to achieve your financial goals.

Key Features of PMS:

- Personalized Investment Strategies – Tailored portfolios based on your financial goals and risk appetite.

- Direct Ownership of Stocks – Unlike mutual funds, PMS investors own individual stocks in their name.

- Active Portfolio Management – Fund managers make real-time decisions to maximize returns.

- Higher Minimum Investment – Typically, PMS requires a minimum investment of ₹50 lakhs, making it suitable for HNIs.

Types of PMS – Which One is Right for You?

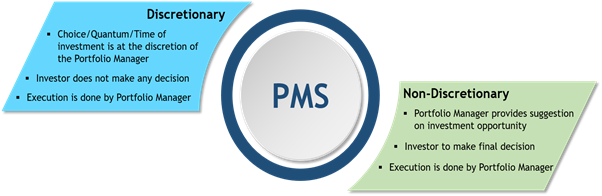

PMS is broadly classified into two types:

1. Discretionary PMS

- The fund manager makes all investment decisions on behalf of the investor.

- Best for investors who want a hands-free investment approach.

2. Non-Discretionary PMS

- The fund manager provides research and recommendations, but the investor makes the final decision.

- Suitable for investors who want more control over their portfolio.

PMS vs. Mutual Funds – What’s the Difference?

| Feature | PMS | Mutual Funds | |

| Customization | Highly Personalized | Standardized for all investors | |

| Ownership | Direct ownership of stocks | Investors own units of the fund | |

| Investment Amount | ₹50 lakh minimum | As low as ₹500 | |

| Control | Investor can influence decisions | Fully managed by fund manager | |

| Fee Structure | Fixed fee + profit-sharing | Expense ratio only |

Which one is better?

- Mutual Funds are great for retail investors looking for affordability and diversification.

- PMS is ideal for HNIs who want personalized investment strategies and direct stock ownership.

Why Choose PMS? – Top Benefits

- Higher Growth Potential – Active management helps in identifying high-growth stocks.

- Exclusive Investment Opportunities – Access to lesser-known but high-return stocks.

- Tax Efficiency – Unlike mutual funds, PMS allows for more tax-efficient strategies.

- Transparency & Flexibility – Investors get regular reports on portfolio performance.

Who Should Invest in PMS?

- High-net-worth individuals (HNIs) with a minimum investment of ₹50 lakhs.

- Investors who want a personalized approach to wealth creation.

- Those who are comfortable with market volatility and long-term investing.

- Individuals looking for better-than-average market returns.

How to Invest in PMS?

- Choose a Reputed PMS Provider – Research the best-performing PMS providers with a strong track record.

- Define Your Investment Goals – Understand your risk appetite and financial objectives.

- Select a Suitable PMS Strategy – Choose between growth, value, or hybrid strategies based on your preferences.

- Monitor Performance – Regularly review portfolio performance and discuss strategies with your fund manager.

Final Thoughts – Is PMS Right for You?

If you’re an investor looking for a customized, high-growth investment strategy, PMS can be a great option. It offers the benefits of active management, direct stock ownership, and exclusive investment opportunities. However, it’s important to choose the right PMS provider and have a long-term investment horizon to maximize returns.

FAQs on Portfolio Management Services

What is the minimum investment required for PMS?

₹50 lakhs as per SEBI regulations.

How is PMS different from mutual funds?

PMS offers personalized stock ownership, while mutual funds pool investments.

Is PMS risky?

Yes, it involves market risks but is actively managed by experts.

Can I withdraw my money from PMS anytime?

Yes, but there may be exit charges or lock-in periods.

Who should invest in PMS?

High-net-worth individuals (HNIs) looking for customized wealth management.

Are PMS returns guaranteed?

No, returns depend on market performance and fund manager strategy.

What are the charges for PMS?

Fees include a fixed management fee and/or a profit-sharing model.

Can I track my PMS portfolio?

Yes, investors get regular reports and performance updates.

What types of assets does PMS invest in?

Mostly equities, but some PMS strategies include debt and alternative investments.

How do I choose the best PMS provider?

Look for a strong track record, investment strategy, and transparency.