Investing your hard-earned money is not just about picking random stocks or mutual funds. It requires careful planning, research, and expertise. Many young investors in India follow social media influencers and make decisions based on trending advice, often leading to costly mistakes. This is where a professional financial advisor or a mutual fund distributor comes in. Having an expert by your side can make your investment journey smoother, more secure, and goal-oriented.

1. Understanding Your Financial Goals

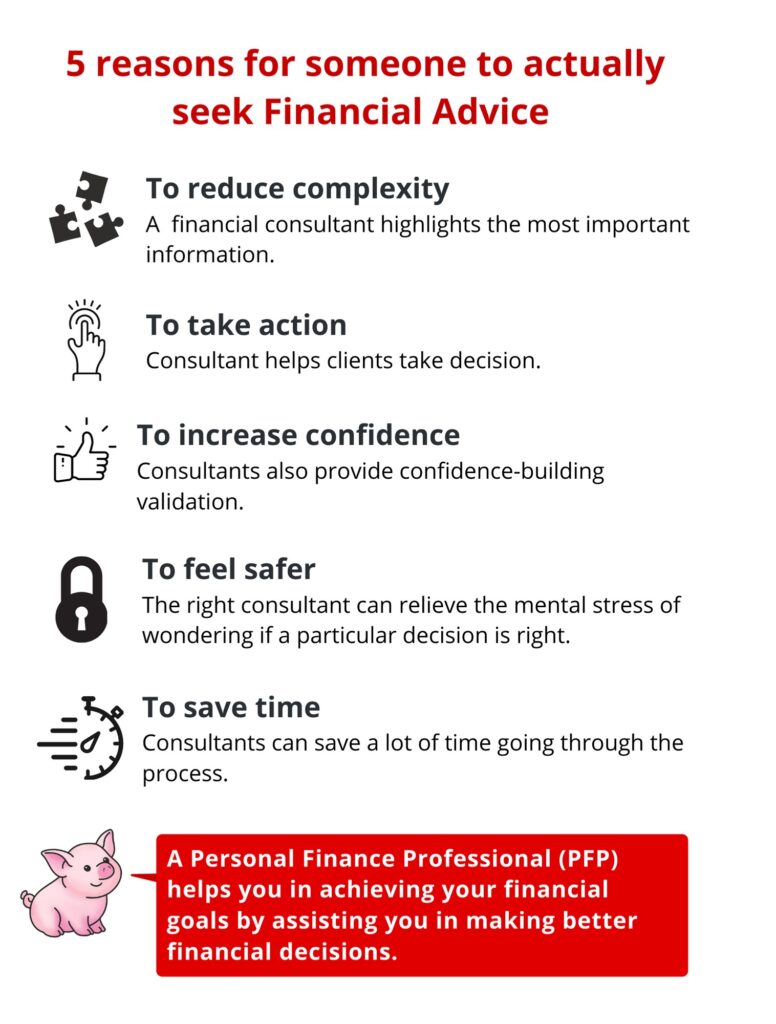

Before investing, you must know why you are investing. Is it for retirement, buying a home, your child’s education, or wealth creation? A financial expert helps you define clear, achievable goals and suggests the best investment options based on your risk appetite and financial situation.

2. Avoiding Common Investment Mistakes

Many investors make decisions based on emotions, market trends, or incomplete knowledge. Common mistakes include:

- Investing without research: Following influencers or friends blindly.

- Overlooking diversification: Putting all money in one asset class.

- Ignoring risk assessment: Not considering your risk tolerance before investing.

- Timing the market: Trying to buy low and sell high, which often leads to losses.

- Neglecting long-term strategy: Panicking during market volatility and withdrawing investments.

A professional advisor helps mitigate these risks by guiding you with a well-structured investment plan.

3. Expertise in Mutual Funds, PMS & AIFs

Investment options like Mutual Funds, Portfolio Management Services (PMS), and Alternative Investment Funds (AIFs) can be complex for a layperson. A professional financial advisor:

- Recommends the right mutual fund schemes based on your goals.

- Helps in selecting PMS for high-net-worth individuals seeking customized portfolios.

- Guides in AIFs, which include hedge funds, private equity, and venture capital.

4. Keeping You Updated with Market Trends

Financial markets keep changing due to economic, political, and global factors. A professional advisor continuously monitors market trends, news, and economic updates to make necessary changes in your portfolio. This ensures that your investments remain aligned with your goals.

5. Tax Efficiency & Compliance

Many investors overlook tax implications while investing. A financial expert helps:

- Choose tax-saving mutual funds like ELSS (Equity Linked Savings Scheme).

- Optimize capital gains tax.

- Ensure proper documentation and regulatory compliance to avoid legal hassles.

6. Financial Discipline & Regular Review

Investing requires discipline and consistency. Many people start investing but fail to review and rebalance their portfolio regularly. A financial expert ensures:

- Regular portfolio assessment.

- Adjustment based on market conditions.

- Disciplined investment through SIP (Systematic Investment Plan) or lump sum as per strategy.

7. Peace of Mind & Long-Term Wealth Creation

Managing investments can be stressful, especially in volatile markets. With an expert guiding you, you get:

- Confidence in financial decisions.

- A stress-free investment experience.

- A path to long-term wealth creation and financial freedom.

Conclusion

Investing is not just about making quick decisions—it’s about making informed and strategic choices. A professional financial service provider ensures that your investment journey is smooth, profitable, and aligned with your financial goals. Don’t let social media myths misguide you; consult an expert to make the most of your hard-earned money!

Frequently Asked Questions (FAQs)

1. Why should I hire a financial advisor when I can invest on my own?

While you can invest independently, financial advisors bring expertise, market knowledge, and strategic planning to help you avoid common mistakes and maximize your returns.

2. Are financial service providers only for the rich?

No! Financial advisors help investors across all income levels. Whether you invest ₹1000 in SIP or ₹1 crore in PMS, having an expert ensures smarter financial decisions.

3. How do I choose the right financial advisor?

Look for:

- Experience and track record.

- Knowledge of Mutual Funds, PMS, AIFs.

- Transparent fee structure.

- Client testimonials and credibility.

4. Do financial service providers guarantee profits?

No, they help in risk management, goal-based planning, and long-term wealth creation.

5. What is the cost of hiring a financial service provider?

Costs vary based on services. Some financial service providers charge fees, while mutual fund distributors earn a commission from Asset Management Companies (AMCs). Always discuss fees upfront.

6. Can I change my financial service provider if I am not satisfied?

Yes, you can change your financial service provider anytime if you feel they are not providing value.