Financial freedom is a goal that everyone dreams of, but only a few achieve. It’s not just about being rich—it’s about having control over your finances, making independent decisions, and living life on your own terms.

What is Financial Freedom?

Financial freedom means having enough savings, investments, and passive income to cover your living expenses without relying on a pay check. It allows you to make choices based on your happiness and goals rather than financial constraints.

Key Steps to Achieve Financial Freedom

1. Set Clear Financial Goals

Before you start your journey, define what financial freedom means for you. Do you want to retire early? Travel the world? Start your own business? Setting clear, achievable financial goals gives you direction and motivation.

2. Build an Emergency Fund

Life is unpredictable. Having an emergency fund of at least 6–12 months’ worth of expenses ensures you won’t fall into debt when unexpected expenses arise. This is your financial safety net.

3. Budget Wisely and Track Expenses

A budget helps you control your spending and allocate funds effectively. Use budgeting apps or spreadsheets to track where your money goes each month. Prioritize savings and cut unnecessary expenses.

4. Eliminate High-Interest Debt

Debt, especially high-interest debt like credit cards, can drain your financial resources. Pay off your debts systematically using methods like the debt snowball (paying smallest debts first) or debt avalanche (paying highest interest debts first).

5. Increase Your Income Streams

Relying on a single income source can be risky. Explore side hustles, freelancing, passive income sources like dividends, rental income, or investments to boost your financial stability.

6. Invest Wisely for Long-Term Growth

Investing is the key to wealth creation. Diversify your portfolio with mutual funds, stocks, real estate, and bonds. SIPs (Systematic Investment Plans) in mutual funds help build wealth steadily over time.

7. Plan for Retirement Early

The earlier you start saving for retirement, the better. Contribute to retirement plans like EPF, PPF, NPS, and pension funds to secure a financially stress-free future.

8. Reduce Lifestyle Inflation

As your income grows, avoid unnecessary lifestyle upgrades. Instead, increase your savings and investments to accelerate your financial freedom journey.

9. Get Proper Insurance Coverage

Medical emergencies or accidents can derail your finances. Health insurance, life insurance, and term insurance provide financial protection for you and your family.

10. Stay Financially Educated

Keep learning about personal finance, investments, and tax-saving strategies. Follow financial news, attend webinars, or consult a financial service provider to make informed decisions.

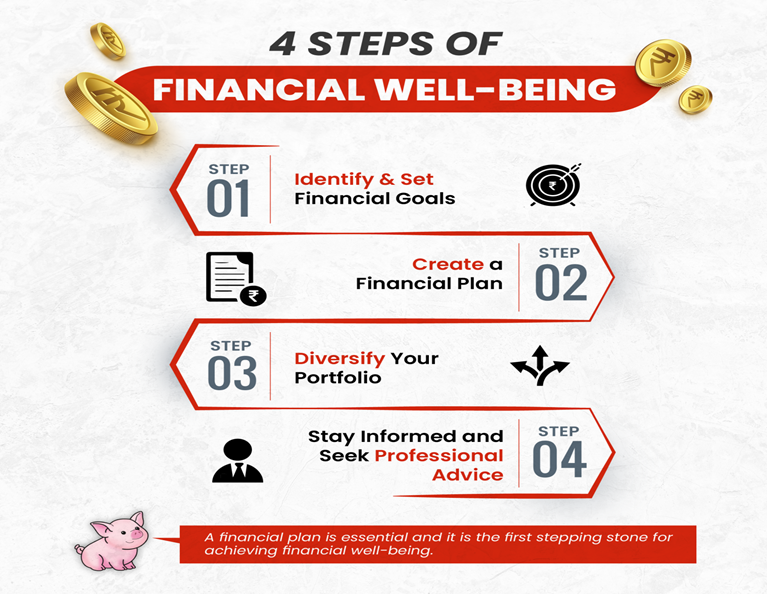

Financial Well-Being: The Key to Long-Term Success

Achieving financial freedom goes hand-in-hand with maintaining financial well-being. Here are the essential steps to keep you on track:

- Identify Your Objectives and Goals

Before diving into any financial plan, identify what you want to achieve. This could be early retirement, buying a home, or achieving financial independence. Clarity of purpose is the first step to financial well-being. - Create a Financial Plan

A clear financial plan outlines the path to reach your goals. Set realistic targets, estimate timelines, and create strategies to monitor your progress. - Diversify Your Portfolio

Diversification helps reduce risk and improve returns. A balanced portfolio of assets like stocks, bonds, real estate, and cash ensures that you are not overly reliant on any single investment. - Stay Informed and Seek Professional Advice

Continuously educate yourself on financial markets, investment strategies, and tax laws. Seek guidance from a certified financial advisor to ensure your strategy is aligned with your long-term goals.

FAQs on Financial Freedom

What is the first step toward financial freedom?

Start by setting clear financial goals and creating a budget to track your income and expenses.

How much money do I need to be financially free?

It depends on your lifestyle, expenses, and financial goals. A good rule is to have investments generating enough passive income to cover your monthly expenses.

Are mutual funds a good option for financial freedom?

Yes, mutual funds help grow wealth over time through compounding, diversification, and systematic investment. SIPs are an excellent way to start.

How can I save more money without cutting all expenses?

Prioritize essential expenses, automate savings, and find ways to increase your income. Cutting small unnecessary costs can also help.

Can financial freedom be achieved on a low income?

Yes! By smart budgeting, reducing debt, and investing wisely, even individuals with a lower income can achieve financial freedom over time.

When should I start investing?

The best time to start investing is now! The earlier you start, the more you benefit from compound interest and long-term market growth.

Why is an emergency fund important?

An emergency fund protects you from financial stress during unexpected situations like job loss, medical expenses, or urgent repairs.

Achieving financial freedom requires discipline, patience, and the right financial choices. Start today, make smart money moves, and enjoy a future where you control your finances—not the other way around!