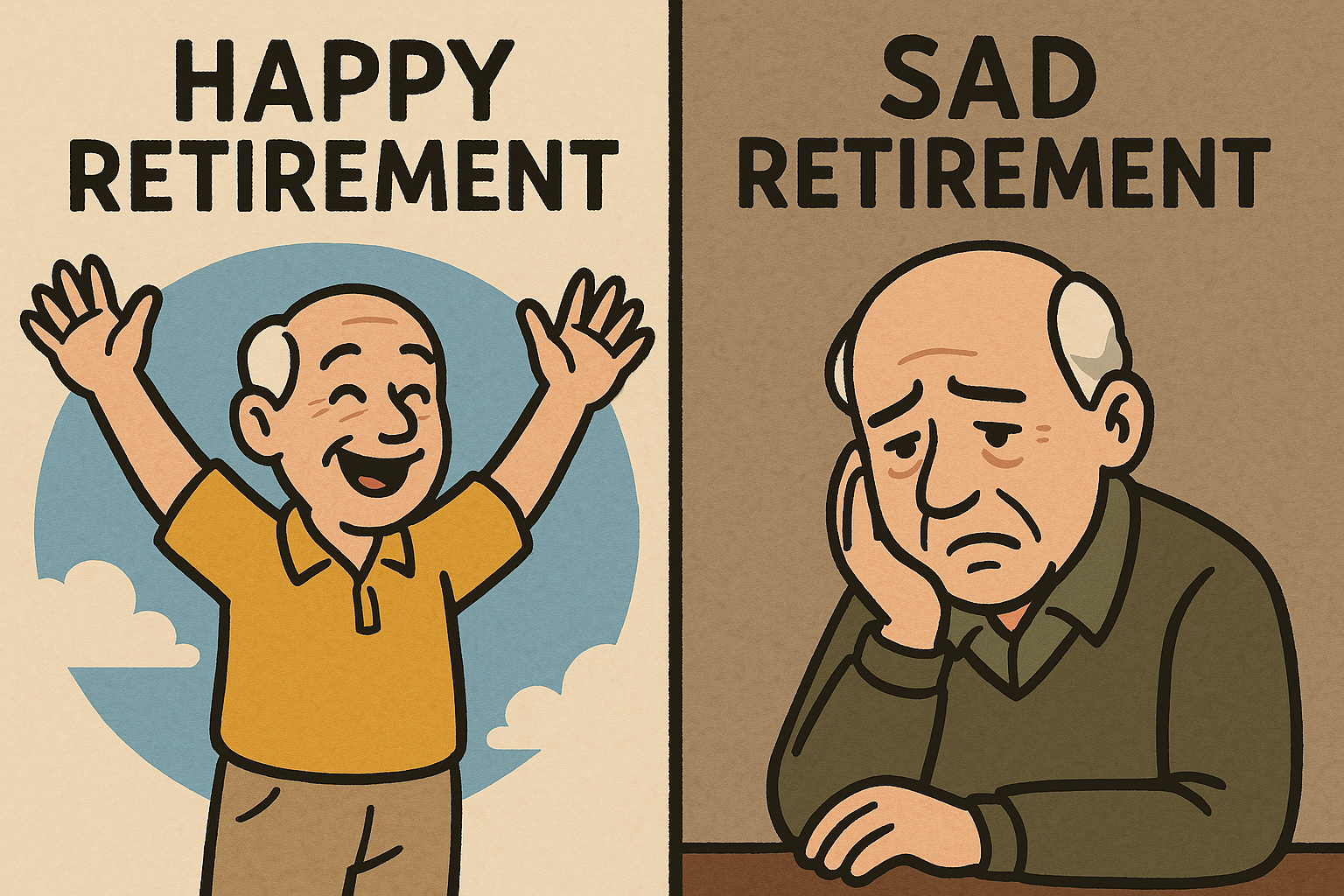

Not just a reflection of who you are today, but the person you will become in 20, 30, or even 40 years. Would that version of you smile with gratitude, knowing you made wise financial decisions? Or would they carry the weight of regret, wishing you had planned better?

The truth is simple: The person that is going to take care of old you is the young you.

💡 Every rupee you invest today shapes your financial security tomorrow.

Yet, too many professionals focus on the present—chasing promotions, handling EMIs, managing family responsibilities—without truly considering their long-term financial well-being. Retirement may seem distant, but the earlier you start preparing, the more comfortable and stress-free it will be.

The Reality Check: Are You Preparing for Future You?

Many professionals assume EPF, PPF, or occasional savings will be enough to retire comfortably. But with rising inflation, increasing healthcare costs, and longer life expectancy, a structured retirement plan is no longer optional—it’s essential.

Here are three eye-opening truths:

✅ You won’t always have the energy to work forever.

✅ Your future expenses will likely be higher than today.

✅ Financial freedom doesn’t happen overnight—it’s built over decades.

So, how do you ensure that your future self-lives with dignity and security?

The Smart Moves Young You Must Make Today

1️⃣ Invest Consistently – Start a strategic SIP in mutual funds with a goal-based approach (retirement, home, healthcare). Compounding is your greatest ally.

2️⃣ Reduce Unnecessary Debt – Every EMI you clear today means fewer financial burdens in the future. Prioritize high-interest debt like credit cards and personal loans.

3️⃣ Build Passive Income Streams – Consider long-term wealth generators such as equity, mutual funds, rental income, or even a side business.

4️⃣ Secure Health & Life Insurance – Medical expenses in old age can drain your savings. A solid health insurance policy can be a lifesaver.

5️⃣ Plan Your Retirement Fund Early – Use an Aatmanirbhar SIP to ensure financial stability in later years. A structured investment plan can turn your dreams into reality.

Meet ‘Future You’ – A Retirement Without Worries

Now, close your eyes and imagine your retirement:

A peaceful home, fully paid off. Traveling, pursuing hobbies, and enjoying life without financial stress. Supporting your family without feeling burdened. Having a steady stream of income even without working.

That version of you is possible—but only if young you take action now.

How We Can Help You Today for a Peaceful Retirement

At LIVEWELL FINSERV, we specialize in crafting customized financial strategies for professionals like you. Whether it’s smart investments, tax-saving strategies, or building a passive income plan, we help you make informed decisions today that secure your tomorrow.

Let’s sit together and ensure that when future you look in the mirror, they see a financially independent and worry-free person smiling back.