Introduction: Tax planning is an essential part of personal finance management that can help you save money and ensure you’re financially prepared for the future. While taxes are inevitable, with the right planning, you can reduce your tax burden and increase your savings. Whether you’re new to tax planning or looking to refine your strategies, this guide will break down tax planning concepts into simple steps. Let’s explore how you can make the most of your tax-saving opportunities.

What is Tax Planning?

Tax planning involves strategically organizing your financial activities to minimize your tax liabilities while ensuring that you comply with tax laws. The goal is not to evade taxes but to make use of the legal exemptions, deductions, and benefits available under Indian tax laws.

Effective tax planning is a year-round process and can be tailored to your income, investments, and financial goals. Proper tax planning helps you to keep more of your hard-earned money and invest it wisely for the future.

Why is Tax Planning Important?

Reduce Tax Liability: By taking advantage of available exemptions and deductions, you can lower the amount of tax you owe.

Maximize Savings: Strategic tax planning helps to grow your savings, as it lets you invest the money saved through tax deductions in the right financial instruments.

Ensure Financial Security: Reducing taxes can help improve your cash flow, allowing you to save and invest for the future, including retirement.

Avoid Penalties: Tax planning ensures that you meet your tax obligations in a timely and correct manner, avoiding penalties or interest charges.

Key Elements of Tax Planning

Understanding Taxable Income and Tax Slabs: The first step in tax planning is knowing your taxable income. Income tax in India is divided into various slabs based on income levels. By understanding your tax slab, you can plan your finances accordingly and try to reduce taxable income by making use of exemptions, deductions, and rebates.

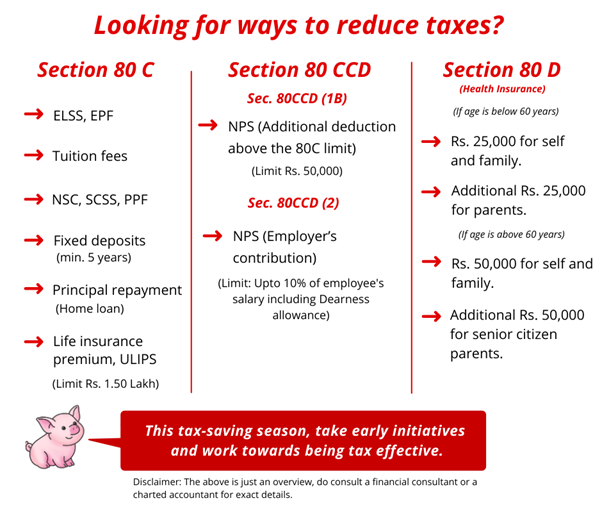

Tax Deductions Under Section 80C: One of the most well-known provisions for tax savings is Section 80C. You can claim deductions up to ₹1.5 lakh on investments in eligible instruments, such as:

Employee Provident Fund (EPF)

Public Provident Fund (PPF)

National Savings Certificate (NSC)

Life Insurance Premiums

Tax-saving Fixed Deposits

National Pension Scheme (NPS)

These instruments not only offer tax benefits but also help build a strong financial foundation for your future.

Tax Benefits on Health Insurance (Section 80D):Under Section 80D, you can claim deductions for premiums paid towards health insurance for yourself, your spouse, children, and parents. The deduction limit is ₹25,000 for individuals below 60 years and ₹50,000 for senior citizens.

Home Loan Interest Deduction (Section 24): You can claim deductions up to ₹2 lakh on the interest paid on home loans under Section 24. This benefit applies for both self-occupied and rented properties.

Capital Gains Tax Planning: Capital gains tax arises when you sell an asset, such as property or mutual funds. However, there are exemptions and benefits available depending on how long you’ve held the asset. Long-term capital gains (LTCG) are taxed at a lower rate, which encourages long-term investments. By holding assets for the required time, you can reduce your tax liability.

Utilizing Exemptions for Agricultural Income: Income derived from agriculture is exempt from tax under Section 10(1), provided certain conditions are met. If you are earning from agriculture, be sure to include it in your tax planning.

Tax Planning Tips for Mutual Fund Investors

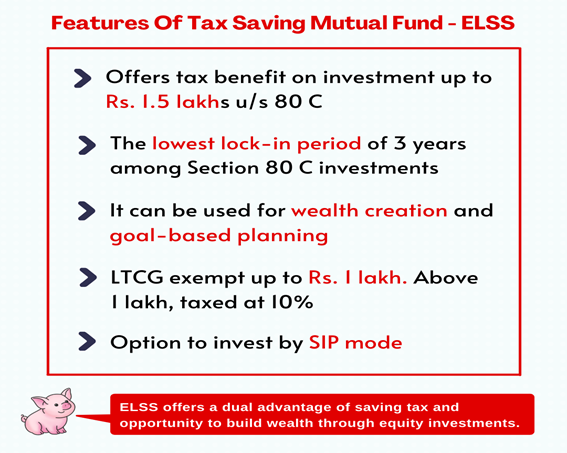

Equity-Linked Savings Schemes (ELSS): ELSS mutual funds offer both capital appreciation and tax-saving benefits. Under Section 80C, investments in ELSS up to ₹1.5 lakh are eligible for tax deductions. Moreover, these funds have a shorter lock-in period (3 years) compared to other tax-saving instruments.

- Taxation of Mutual Fund Dividends: Dividends from mutual funds are taxable in the hands of the investor. However, if you opt for growth-oriented mutual funds, you can avoid taxes on dividends and benefit from long-term capital appreciation instead.

- Systematic Investment Plans (SIP): Regular SIPs in tax-saving mutual funds like ELSS can help in spreading your investment over time, thus averaging your cost of investment and tax liabilities.

Common Tax Planning Mistakes to Avoid

- Procrastinating Tax Planning: Many individuals wait until the end of the financial year to start their tax planning. This can lead to missed opportunities. Start early to maximize your benefits.

- Ignoring Tax Implications of Investments: Not all investments offer tax benefits. Some can be subject to capital gains taxes. Be mindful of tax implications when choosing investment instruments.

- Not Utilizing All Available Deductions: Often, individuals miss out on tax-saving options due to lack of awareness. Be sure to explore all available deductions, such as those for educational loans, donations, and more.

- Overlooking Tax Planning for Senior Citizens: Senior citizens are eligible for additional tax benefits, such as higher deductions for medical insurance. Don’t miss out on these benefits.

Conclusion

Tax planning doesn’t have to be complex or intimidating. By understanding the various exemptions, deductions, and instruments available, you can reduce your tax liability and keep more of your earnings. It’s about being strategic and using your financial knowledge to your advantage. If you start planning your taxes early and invest wisely, you will see the benefits in the form of greater savings and financial security.

Always consult a tax professional to tailor your tax planning strategy based on your personal situation and goals.

Frequently Asked Questions (FAQs)

- What is the difference between tax avoidance and tax evasion?

- Tax avoidance is the legal practice of minimizing tax liabilities by using deductions, exemptions, and allowances available under the law.

- Tax evasion, on the other hand, involves illegal practices, such as underreporting income or hiding assets, to avoid paying taxes.

- Can I invest in multiple tax-saving instruments?

Yes, you can invest in various tax-saving instruments to maximize your deductions, such as PPF, ELSS, and NPS. Just ensure that the total deduction doesn’t exceed the prescribed limits.

- Is tax planning only for high-income earners?

No, tax planning is beneficial for everyone, regardless of income level. Even if you have a modest income, you can still take advantage of exemptions and deductions to reduce your tax liabilities.

- How can I check my tax liability?

You can calculate your tax liability using online tax calculators or consult a tax professional. The calculation depends on your income, applicable tax slabs, deductions, and exemptions.

- What are the tax-saving benefits of investing in NPS (National Pension Scheme)?

Contributions to NPS are eligible for tax deductions under Section 80CCD(1B) up to ₹50,000 over and above the ₹1.5 lakh limit of Section 80C, making it a great option for additional tax savings.

- Do mutual funds provide tax-saving benefits?

Yes, investing in Equity-Linked Savings Schemes (ELSS) provides tax-saving benefits under Section 80C. They also offer potential for high returns, making them a popular choice for tax planning.