In today’s fast-paced world, securing your family’s future is more important than ever. One of the simplest and most effective ways to do this is by investing in term insurance. But what exactly is term insurance, and why is it so important? Let’s break it down in simple words so you can make the best decision for your financial future.

2. What is Term Insurance?

Term insurance is a type of life insurance that provides coverage for a specific period, like 10, 20, or 30 years. If something unfortunate happens to you during this period, your family receives a lump sum amount (called the sum assured). This money can help them pay for daily expenses, loans, education, or any other financial needs.

Think of it as a safety net for your loved ones. It’s affordable, straightforward, and offers high coverage at a low cost.

3. Why is Term Insurance Important?

Here are 5 reasons why term insurance should be a part of your financial plan:

a) Protects Your Family’s Future

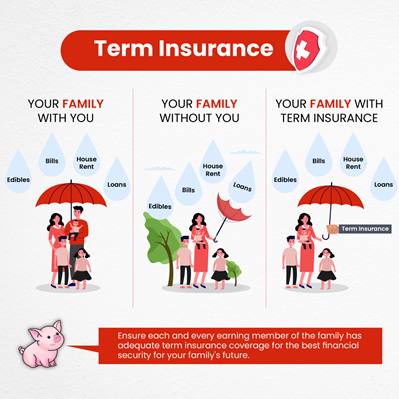

Life is unpredictable. If you’re the sole breadwinner, your family could face financial struggles in your absence. Term insurance ensures they have the funds to maintain their lifestyle and meet important goals like education or marriage.

Story:

Imagine a father who unexpectedly passes away, leaving behind a wife and two children. Without term insurance, his family would struggle to pay for the children’s education or keep up with daily expenses. However, with term insurance, the family receives the sum assured, ensuring they can continue living without significant financial stress.

b) Affordable and High Coverage

Compared to other insurance plans, term insurance is very cost-effective. You can get a high coverage amount (like ₹1 crore or more) by paying a small premium annually. It’s a small price to pay for peace of mind.

Story:

Raj, a 30-year-old professional, pays just ₹10,000 annually for ₹1 crore of term insurance. For the price of a monthly dinner outing, he’s secured his family’s future. The best part? His premiums are locked in at a low rate since he took the policy while young.

c) Helps Pay Off Debts

Do you have a home loan, car loan, or other debts? If something happens to you, your family might struggle to repay these. Term insurance ensures your debts are taken care of, so your loved ones aren’t burdened.

d) Supports Long-Term Goals

Whether it’s your child’s education or their wedding, term insurance ensures these dreams aren’t compromised, even in your absence.

Story:

Vikram had always dreamt of sending his daughter abroad for higher studies. His term insurance plan provides the funds for her education, even though he is no longer around, ensuring that his dream for her future remains intact.

e) Tax Benefit

Did you know? The premiums you pay for term insurance are eligible for tax deductions under Section 80C of the Income Tax Act. This means you save taxes while securing your family’s future.

4. Common Myths About Term Insurance

Let’s clear up some misconceptions:

Myth 1: “Term insurance is expensive.”

Fact: It’s one of the most affordable insurance options available.

Myth 2: “I don’t need term insurance if I’m young and healthy.”

Fact: The younger you are, the lower your premiums. It’s the best time to buy!

Myth 3: “I already have life insurance through my employer.”

Fact: Employer-provided insurance is often insufficient. A personal term plan ensures complete coverage.

5. How to Choose the Right Term Insurance Plan?

Here’s a quick checklist to help you pick the best plan:

a. Coverage Amount:

Choose a sum assured that covers your family’s needs, including debts and future goals.

b. Policy Tenure:

Select a term that aligns with your financial responsibilities (e.g., until retirement or until your kids are financially independent).

c. Riders:

Add-ons like critical illness or accidental death coverage can enhance your plan.

d. Claim Settlement Ratio:

Check the insurer’s claim settlement ratio to ensure they have a good track record of paying claims.

6. Conclusion

Term insurance is not just a policy; it’s a promise to your family that they’ll be taken care of, no matter what. It’s a simple, affordable, and effective way to ensure their financial stability. Don’t wait for the “right time”—start today and give your loved ones the gift of security.

If you’re unsure which term insurance plan is best for you, feel free to reach out to us. We’re here to help you make informed decisions and secure your family’s future.

FAQs About Term Insurance:

1. What is the best age to buy term insurance?

- Answer: The best age to buy term insurance is when you are young and healthy, ideally in your 20s or early 30s. The premiums are lower, and you lock in coverage at an affordable rate.

2. Can I change my sum assured during the policy tenure?

- Answer: Yes. Many insurers allow you to increase or decrease your sum assured during the policy tenure, depending on your changing financial needs.

3. Is term insurance a good investment option?

- Answer: Term insurance is not an investment plan. It provides pure life coverage and helps secure your family’s future in case of an unfortunate event. For investments, consider other products like mutual funds or ULIPs.

4. What happens if I miss a premium payment?

- Answer: If you miss a premium payment, most term insurance policies offer a grace period (typically 30 days). If the premium remains unpaid after this period, the policy may lapse, and you will lose coverage.

5. Can I cancel my term insurance policy and get a refund?

- Answer: Yes. Most insurers offer a “free look period” (usually 15-30 days) where you can review the terms and cancel the policy for a refund. However, after this period, refunds are not applicable.

6. Is term insurance tax-free?

- Answer: Yes, the death benefit paid to the nominee is tax-free under Section 10(10D) of the Income Tax Act. Additionally, the premiums paid are eligible for tax deductions under Section 80C.

7. Can I buy multiple term insurance policies?

- Answer: Yes. You can buy multiple term insurance policies to increase your coverage, if the total sum assured reflects your financial needs and responsibilities.