If you’re thinking about investing or already in the market, you’ve probably heard the term Sensex. But what is it, and why is it so significant? This blog will take you through the history of Sensex in simple terms, explaining how it became India’s top stock market benchmark and how you can use it to make better investment decisions.

- What is Sensex?

Simply put, Sensex (short for Sensitive Index) is a gauge of how the stock market is performing in India. It tracks the top 30 companies listed on the Bombay Stock Exchange (BSE) and serves as a reflection of the country’s economic health. If the Sensex is rising, it typically indicates a strong economy and positive market sentiment. If it’s falling, it may signal potential economic concerns.

3. The Birth of Sensex:

Launched on January 1, 1986, the Sensex had an initial value of 100. Back then, India’s economy was more closed and heavily regulated. Sensex was created as a simple yet effective way for investors to track the market’s performance and growth over time. Little did people know that this index would go on to become one of the most influential financial benchmarks in India.

4. Key Milestones in Sensex’s History:

Let’s take a look at some defining moments in the history of Sensex:

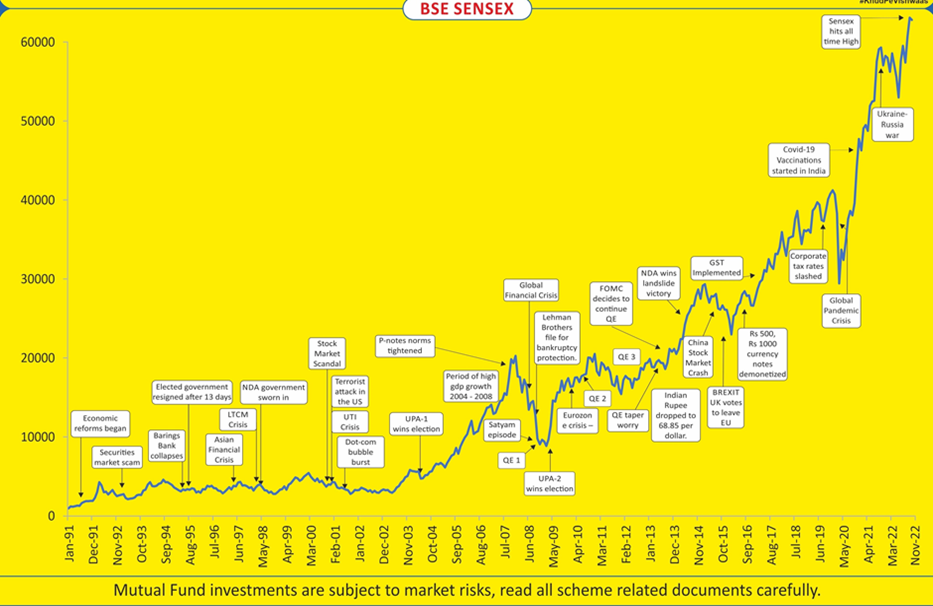

- 1991: Economic Liberalization

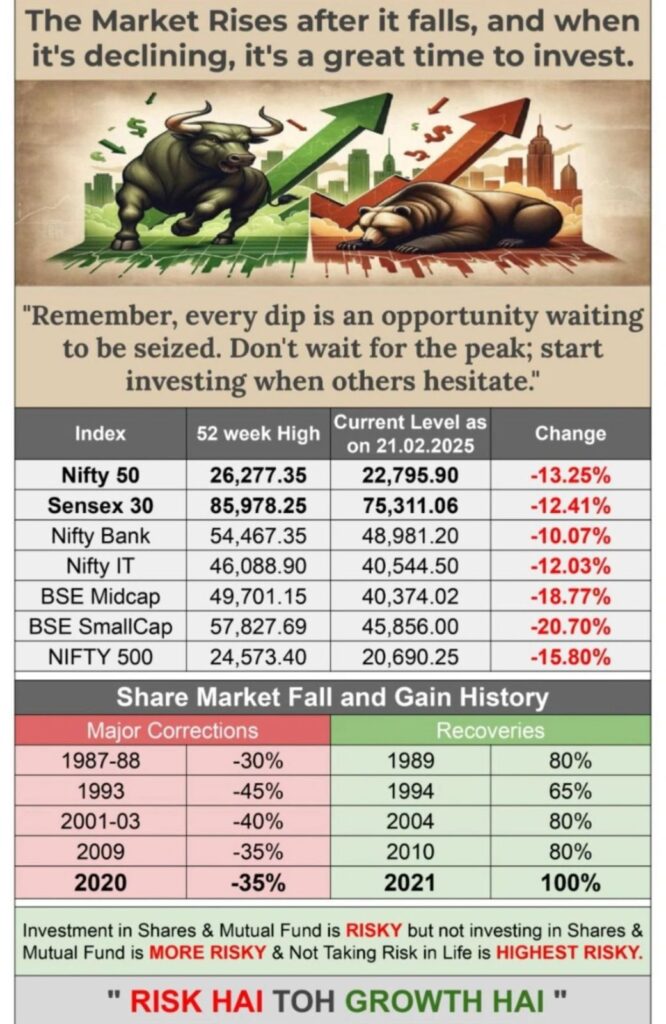

India took its first steps toward opening up its economy, and the stock market responded positively. Sensex began its upward journey as foreign investments flowed in. - 2000: Crossing the 5,000 Mark

The new millennium saw the Sensex cross the significant 5,000 mark, driven by the growth of the IT sector and the rise of companies like Infosys and Wipro. - 2008: The Global Financial Crisis

In the wake of the global financial crisis, Sensex took a massive hit, falling to around 8,000 points. Despite the downturn, the Sensex proved its resilience by recovering strongly in the following years. - 2020: The COVID-19 Pandemic

The pandemic caused a sharp dip in the Sensex, but the market rebounded quickly and crossed the 50,000 mark in 2021, showing the potential of long-term investments even in turbulent times.

5. Why is Sensex Important for Investors?

The Sensex is more than just a number—it’s a key indicator of how India’s stock market and economy are performing. Here’s why it matters to you:

- Market Indicator: The Sensex provides an overview of the market’s health, helping you gauge whether it’s a good time to invest.

- Investment Benchmark: Many mutual funds and portfolios use the Sensex as a benchmark for performance, allowing investors to measure their fund’s returns against the broader market.

- Economic Reflection: A rising Sensex often reflects a growing economy, while a declining Sensex may indicate economic challenges.

·

6. How Can You Use Sensex to Your Advantage?

- Track Trends: Regularly monitor Sensex movements to understand how the market is performing and make informed investment choices.

- Invest for the Long Term: Historically, Sensex has provided strong returns over the long run. Staying invested through ups and downs can help you build wealth over time.

- Diversify Your Portfolio: Consider investing in index funds or ETFs that track the Sensex for a diversified and balanced portfolio.

·

7. Conclusion:

The Sensex has come a long way since its inception, and it continues to be a valuable tool for investors in understanding the performance of India’s stock market. Whether you’re new to investing or a seasoned pro, keeping an eye on the Sensex is essential for making smart investment choices.

we are here to guide you on your investment journey and help you grow your wealth. Feel free to reach out for more advice on mutual funds and how to make the most out of your investments.

FAQs about Sensex:

Q1: What does Sensex represent?

A1: Sensex represents the performance of the top 30 companies listed on the Bombay Stock Exchange (BSE), reflecting the overall health of the Indian stock market.

Q2: How is Sensex calculated?

A2: The Sensex is calculated using the free-float market capitalization method, where the weightage of each stock is proportional to its market value.

Q3: Why should I track Sensex?

A3: Tracking the Sensex helps you understand market trends, make informed investment decisions, and gauge the economic health of the country.

Q4: How does Sensex affect my investments?

A4: A rising Sensex indicates a thriving market, which is often a good time for investments. A falling Sensex may prompt you to reassess your investment strategy.Q5: Can I invest directly in Sensex?

A5: While you can’t invest directly in the Sensex, you can invest in index funds or ETFs that track the Sensex, allowing you to gain exposure to the index.