Inflation is a term we often hear in the news, but what does it really mean? How does it impact your everyday life and, more importantly, your financial goals? Let’s break it down in simple terms so you can stay informed and make better financial decisions.

What is Inflation?

Inflation refers to the rise in the prices of goods and services over time. In simple words, it means that the same amount of money can buy fewer things today than it could in the past. For example, if a cup of coffee cost ₹50 five years ago and costs ₹70 today, that’s inflation at work.

What Causes Inflation?

Inflation can happen for several reasons, but here are the two main types:

- Demand-Pull Inflation: This happens when the demand for goods and services exceeds their supply. For instance, if more people want to buy houses but fewer houses are available, prices go up.

- Cost-Push Inflation: This occurs when the cost of producing goods and services rises. For example, if oil prices increase, transportation costs go up, and so do the prices of goods that rely on transportation.

How Does Inflation Affect You?

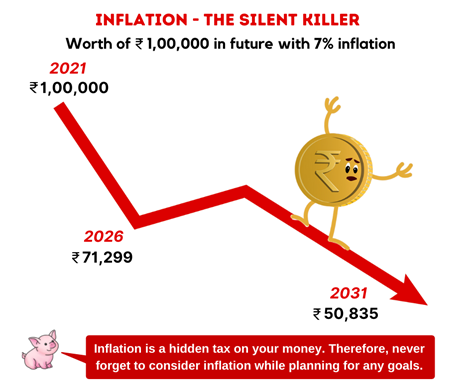

- Reduced Purchasing Power: As prices rise, your money loses value. For instance, if inflation is at 6% annually, something that costs ₹100 today will cost ₹106 next year.

- Impact on Savings: Inflation can erode the value of your savings. If your savings grow at 4% per year but inflation is at 6%, your real returns are negative (-2%).

Higher Cost of Living: Everyday expenses such as groceries, fuel, and rent become more expensive, making it harder to stick to your budget.

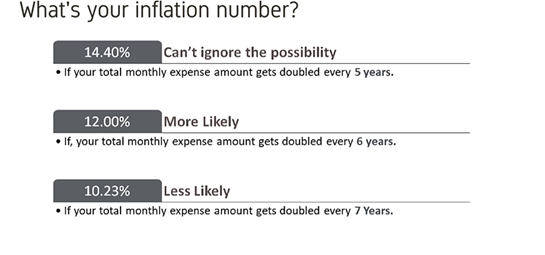

This image shows how quickly your expenses could double due to inflation. Different inflation rates are linked to how often your expenses might double. It highlights the need to consider inflation in your financial planning.

- Impact on Loans: Inflation can work both ways here. If you have a fixed-rate loan, inflation reduces the real value of your repayments over time. However, new loans might come with higher interest rates.

Why Should Investors Care About Inflation?

Inflation doesn’t just affect daily expenses; it can also impact your investments. Here’s how:

- Eroding Returns: If your investments don’t grow faster than the inflation rate, you’re actually losing money in real terms.

- Equity Markets: Inflation can lead to volatility in stock markets. Companies with high costs might struggle to maintain profits, affecting their stock prices.

- Fixed Income Investments: Investments like fixed deposits or bonds can become less attractive during high inflation since their returns may not keep up with rising prices.

How Can You Protect Your Money from Inflation?

- Invest in Mutual Funds: Equity mutual funds have the potential to provide higher returns over the long term, helping you beat inflation.

- Diversify Your Portfolio: Spread your investments across different asset classes like equities, debt, and gold to manage risk and returns effectively.

- Consider Inflation-Linked Investments: Some government bonds are designed to adjust for inflation, ensuring your returns aren’t eroded.

- Review and Rebalance Regularly: Monitor your investments to ensure they align with your financial goals and the current inflation rate.

Final Thoughts

Inflation is a reality we can’t escape, but understanding it is the first step toward managing its impact on your finances. By planning smartly and investing wisely, you can ensure that your money retains its value and grows over time.

At Livewell Finserv, we’re here to help you navigate inflation and make informed investment decisions. Contact us today to learn how we can help you build an inflation-proof portfolio!

FAQs About Inflation:

- What is inflation and why should I care about it?

Inflation is the rise in prices over time, reducing your money’s purchasing power. It impacts savings and investments.

- How does inflation affect my savings?

Inflation erodes the value of your savings if your returns are lower than inflation.

- What impact does inflation have on my investments?

Inflation reduces the real returns on your investments and can cause market volatility.

- How can I protect my investments from inflation?

Invest in equities, gold, and inflation-linked bonds to protect against inflation.

- What types of mutual funds are best for beating inflation?

Equity mutual funds offer long-term growth potential to outpace inflation.

- Should I change my investment strategy because of inflation?

Review and diversify your portfolio regularly to manage inflation risks.

- How does inflation affect fixed-income investments like bonds?

Inflation makes bonds and fixed deposits less attractive as their returns may not keep up with rising prices.

- Can mutual funds help me cope with rising inflation?

Yes, mutual funds, especially equity funds, can help outpace inflation over time.

- What steps should I take to manage inflation in my portfolio?

Diversify, rebalance regularly, and invest in inflation-hedging options like equities and gold.

- Can Livewell Finserv help me build an inflation-proof portfolio?

Yes, we offer tailored investment strategies to protect and grow your wealth despite inflation